Eco-efficiency pays dividends year after year.

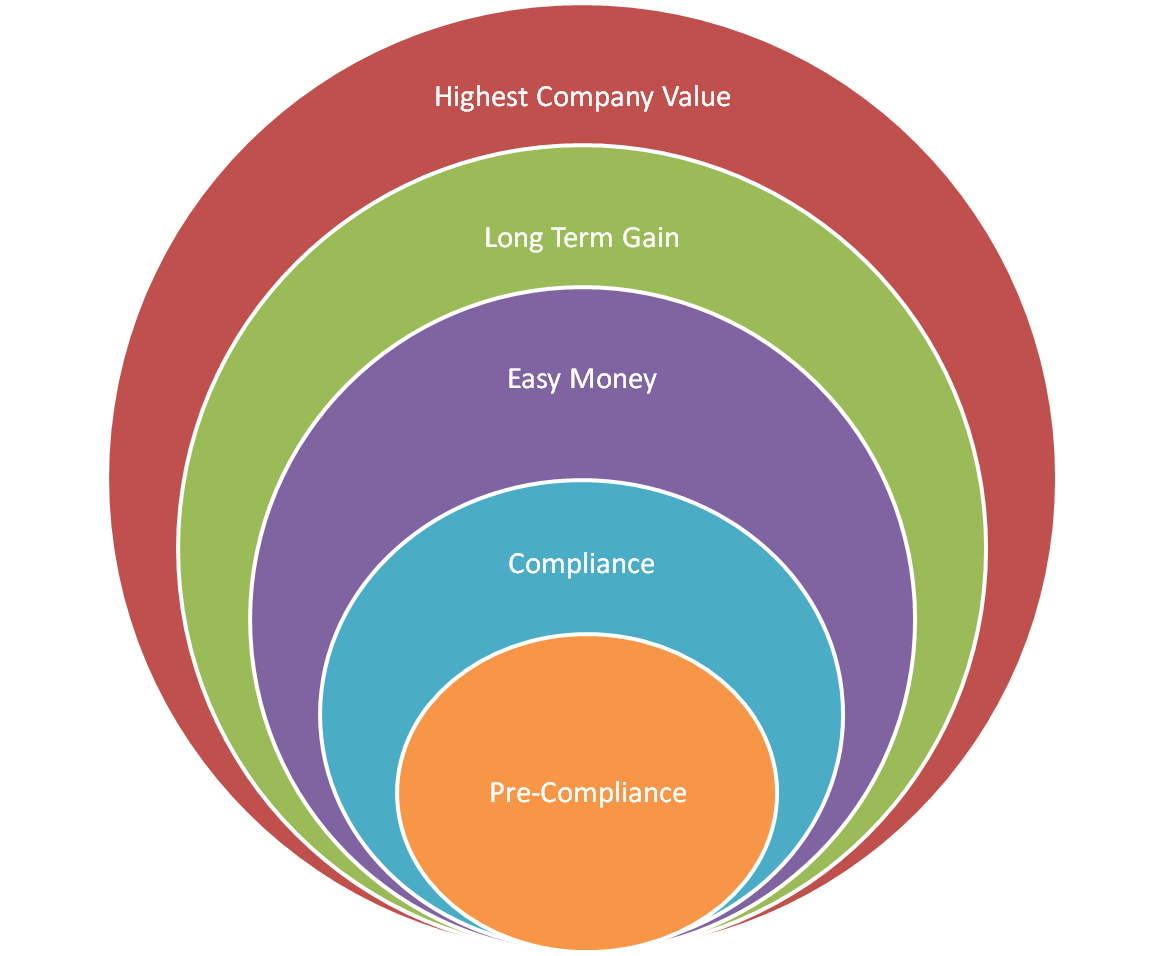

Various practitioners have different titles and phases for implementing sustainability in organizations (and buildings for that matter). I have taken those stages and put them in financial terms. The good news is the more mature you get in the phases, the more money you make over time.

1. Pre-compliance was what we had at the turn of the 20th century all the way until as late as the 1960's. Reckless abandon with regard to worker rights, the environment and the community.

2. Compliance is where about 90% of buildings and companies are right now. They are doing what they need to do to meet the minimal requirements to stay out of the courts.

3. Easy money is the current sweet spot for most companies and buildings. If you haven't initiated any green initiatives or if you've implemented only a few, this is where to start. Usually by upgrades in buildings and the waste stream you can see huge savings. There are two great benefits to this phase at this point in history. First, there are plenty of tax breaks that make this available without any money up front and immediate additional cash flow. Second, these items require no cultural or work practice changes by employees or building occupants. So they can be done easily for immediate cash flow.

4. Long Term Gain happens when you combine what you have already done in stage 3 to changing procedures, supply issues, stakeholder relationships and more. At this phase your profit margins will soar as you can keep price where it is (or even raise price) but your customers stay with you and you even gain more customers because your reliability is so high and people like dealing with a firm they can trust (see the book "Firms of Endearment" for plenty of evidence of this). You will be able to recruit and keep the best employees and they will be more productive than they would have been if they worked for your competitors. You are now in the virtuous cycle (the opposite of a vicious cycle). At this phase employee turnover is very low, customer loyalty is high, margins are high and sales can withstand economic downturns. If you don't believe it just ask the owners of Stonyfield Yogurt, The Body Shop and many more...

5. Highest Company Value is where the dividends really pay. Because your firm has such high margins and is at low risk, the value of the company itself is very high. When you are ready to take on new investors or sell the company or building, you will get a premium price for it.

The bottom line: The more eco-efficient you are the more money you make at every phase of implementation.

In today's podcast we hear a great story from Eric Lowitt about how he is following his dreams and helping move sustainability forward in the business sector. I can't wait to get my hands on his new book "The Future of Value" when it comes out in late September.

Eric has a passion for sustainability that is unstoppable. He also has that rare set of business experience and real world school of hard knocks that makes his story great. We'll hear what seperates his book from the others and what his clients are doing to become more sustainable.

In today's podcast we hear a great story from Eric Lowitt about how he is following his dreams and helping move sustainability forward in the business sector. I can't wait to get my hands on his new book "The Future of Value" when it comes out in late September.

Eric has a passion for sustainability that is unstoppable. He also has that rare set of business experience and real world school of hard knocks that makes his story great. We'll hear what seperates his book from the others and what his clients are doing to become more sustainable.